SMMT key points of April registrations

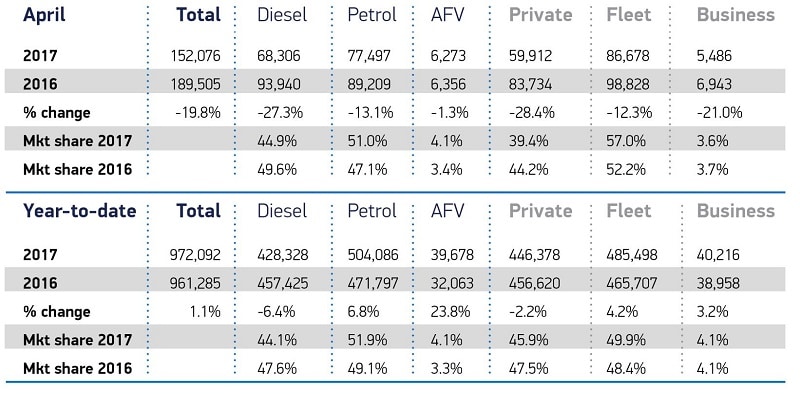

- New car registrations fall -19.8% to 152,076 units as market reflects Vehicle Excise Duty (VED) changes

- First downturn in alternatively fuelled vehicle segment for 47 months as hybrid demand hit by higher VED rates.

- Year-to-date market remains strong, up 1.1%, with record 972,092 cars registered in first four months.

A NEAR 20% fall in car and van registrations in April amid a cocktail of causes is no cause for concern in a “robust market” says the SMMT after publishing the figures.

For cars it was the month’s lowest figures in five years in the expected response to new VED rates. Meanwhile the overall market swing to petrol preference over diesel continued.

It followed an all-time record month’s tally in March of 562,337 as car buyers raced to beat the new road tax – especially on previously tax-free low emission cars such as hybrids – that will bring in billions extra for the Government over the next three years alone. It was also the first month of the new 17 registration plate.

Figures published by the Society of Motor Manufacturers and Traders (SMMT) show that 152,076 new cars were registered in April, a 19.8% decline for the month year-on-year.

But demand for vans, unaffected by the VED changes and so not mirroring the March cars boom, also dropped – down by 18.8% to 22,625 against April 2016’s highest figures on record.

Appointed Representative Opportunities with Wessex Fleet

Have you thought about growing your broker business? Are you looking for opportunities for growth? Then why not consider joining Wessex Fleet as an Appointed Representative?

Keeping you on the move with leasing solutions tailored to your needs

Leasys is the proud Contract Hire partner of the Stellantis brands, offering mobility solutions from medium and long-term rentals to management systems for company fleets.We work with Brokers to support all their customers requirements.

Accelerate your business with QV Systems & Leaselink

Unlock unparalleled efficiency in vehicle procurement with QV Systems’ Accelerate, now seamlessly integrated with Ebbon Automotive’s Leaselink. Tailored for brokers and funders, this integration streamlines the entire process from quote to delivery, empowering you to effortlessly source and order vehicles for your clients.

For cars, demand was down across the board, with registrations by private buyers, businesses and large fleets falling 28.4%, 21.0% and 12.3% respectively.

Petrol, diesel and alternatively fuelled vehicle registrations also declined, with AFV demand down for the first time in 47 months, albeit by a marginal 1.3% or less than 100 cars.

Petrol continued to be the fuel of choice with 51% of the registrations against 44.9% for declining diesel, continuing the swing which year-to-date gives petrol 51.9% of the market against 44.1% diesel with alternatively fuelled vehicles (AFV) at 4.1%. See JATO analysis ‘Tough times for diesel’.

However it is worth bearing in mind that SMMT data for March obtained by Leasing Broker News showed fleets still preferring diesel against petrol by nearly 2:1, with 196,391 diesel fleet registrations against 104,497 petrol – indicating that private buyers, usually with far lower mileages and not demanding the diesel torque, are dominating the petrol preference charts.

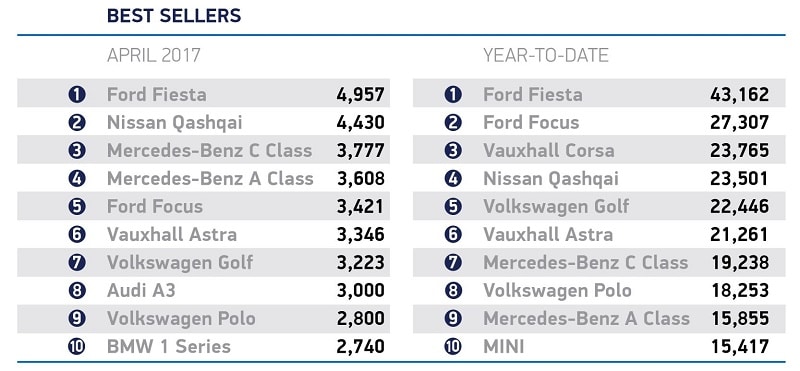

Changes in best seller chart

- The lower registrations also saw some interesting changes in the best sellers top ten, with Ford Fiesta still top but Nissan Qashqai up to second, followed by a brace of rising Mercedes with the C-Class third and A-Class fourth, pushing the year’s second best selling Ford Focus down to fifth and the year’s No3 the Vauxhall Corsa out of the top ten completely as the Audi A3 and BMW 1 Series entered the chart.

Despite the substantial falls in the month, the overall new car market remains strong in the year to date, with new registrations in the first four months up 1.1% year-on-year to 972,092 – the highest level on record.

SMMT chief executive Mike Hawes said: “With the rush to register new cars and avoid VED tax rises before the end of March, as well as fewer selling days due to the later Easter, April was always going to be much slower.

“It’s important to note that the market remains at record levels as customers still see many benefits in purchasing a new car. We therefore expect demand to stabilise over the year as the turbulence created by these tax changes decreases.”

The LCVs front saw declines across all van segments, but pick-up demand continuing an upward trend, rising 4.5% in April and 17.6% YTD, with overall year-to-date registrations down 4.9%, but demand for vans remaining at a high level.

The small and large van segments both experienced a decline in April, with demand for vans under 2.0 tonnes down again, this time by 37.5%, while vans weighing 2.5-3.5 tonnes fell 23.1% reflecting a preference for large vans . The medium sized van market, however, remained broadly stable, dipping just 0.2%,

Mike Hawes said: “April is traditionally a small month for new LCV registrations following the plate-change in March and, coming on the back of double-digit growth that resulted in a record April in 2016, this month’s decline comes as no surprise.

“Overall, the market remains robust, however, and so long as business confidence among operators can be maintained, we expect to see the market remain at what is a historically high level over the course of the year.”