A DECREASE in car registrations in August should not cause alarm, previous years’ August figures, traditionally a slow sales month, have been boosted by the need to buy ahead of WLTP changes in September.

Jon Lawes, Managing Director, Hitachi Capital Vehicle Solutions said the drop could indicate the rise in July was from supressed demand forced by lockdown as the industry began to slowly re-open.

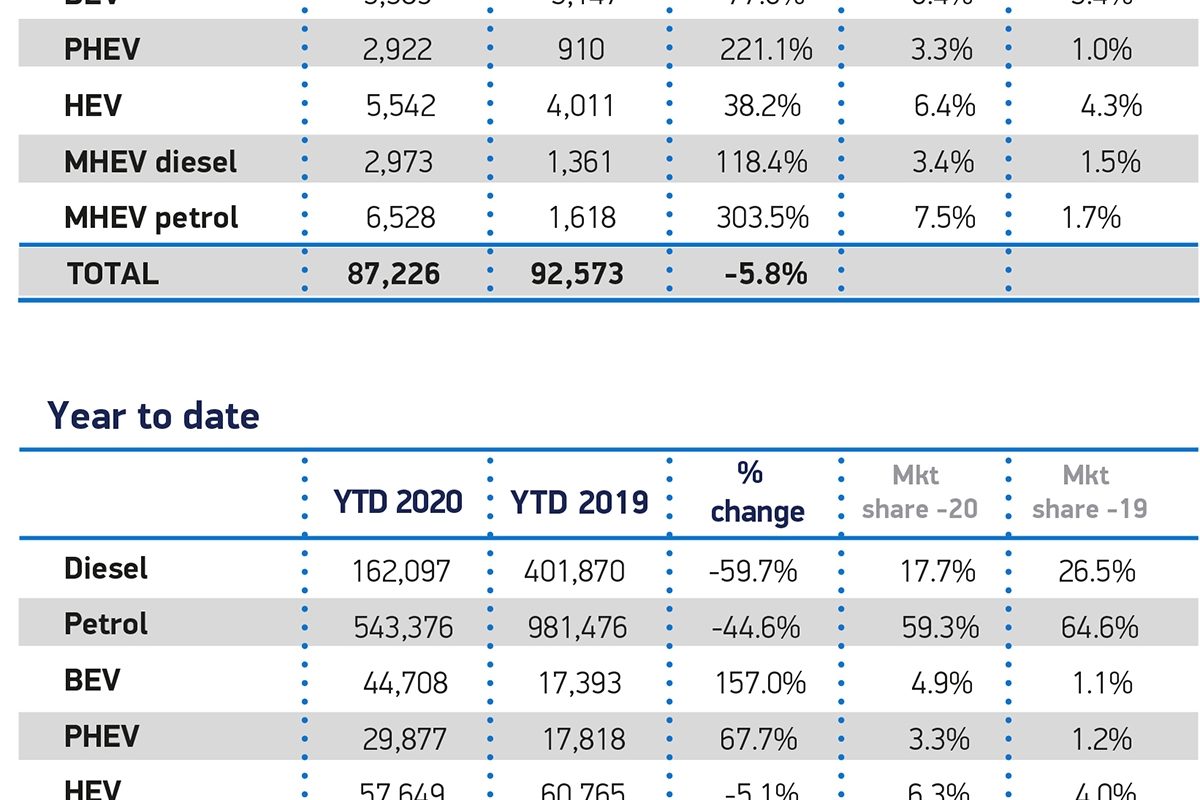

According to the latest SMMT figures, new car registrations during August fell 5.8% to just over 87,000 vehicles.

Lawes said: “Demand for electric vehicles continues to be a bright spot, with battery electric vehicles increasing by 77%. But there are still cost and charging infrastructure concerns that we need to address to reach 2030 government targets, as the SMMT has called for.

“August is also typically a quieter month and with new 70 plates causing excitement for September, next month’s figures could provide a real indicator on the health of the industry.”

Appointed Representative Opportunities with Wessex Fleet

Have you thought about growing your broker business? Are you looking for opportunities for growth? Then why not consider joining Wessex Fleet as an Appointed Representative?

Keeping you on the move with leasing solutions tailored to your needs

Leasys is the proud Contract Hire partner of the Stellantis brands, offering mobility solutions from medium and long-term rentals to management systems for company fleets.We work with Brokers to support all their customers requirements.

Accelerate your business with QV Systems & Leaselink

Unlock unparalleled efficiency in vehicle procurement with QV Systems’ Accelerate, now seamlessly integrated with Ebbon Automotive’s Leaselink. Tailored for brokers and funders, this integration streamlines the entire process from quote to delivery, empowering you to effortlessly source and order vehicles for your clients.

Russell Adams, commercial vehicle manager at Lex Autolease, said that as lockdown restrictions continue to ease and the UK gets back to business, LCVs will play a critical part in the UK’s long-term green recovery – given their prominence in urban areas.

He added: “The recent lockdown has given us a glimpse of what a greener future could look like. With plans for Clean Air Zones in cities across the UK firmly on the table, demand among businesses for their fleets to have the newest and cleanest vehicles is continuing to rise. We’re working closely with our customers to help them identify where electric vans can be most sensibly and easily introduced into their business.

“The key is to identify the tipping point between new models entering the market, advances in battery technology and charging infrastructure versus the practical demands of their day-to-day operations. For vans weighing 3.5t and above, the cleanest diesel technology is still the most practical option, whereas, in the lighter ranges, the transition to electric can be more favourable.

“The most challenging aspect has been waiting for the right vehicles to become available on the market. As we start to see more and more OEMs introduce new models, I believe van operators are becoming more engaged to make the switch from ICE vehicles to electric.

“Ultimately, a van is a tool to do a job and, in these times more than ever, operators need their vans to be out on the roads making money, while keeping costs to a minimum. But, deployed correctly, an alternatively-fuelled LCV can deliver cost savings and increased reliability. As the country heads towards a net-zero emissions future, early adopters of the technology can get ahead of the curve and maximise the cost and environmental benefits.”

Michael Woodward, UK Automotive Lead at Deloitte, said there is hope that September, a key month for new car sales, will be a bumper month for the industry as consumers take advantage of enticing discounts to secure a new 70 plate.

“However, according to our latest research, nearly half of consumers are planning to keep their current vehicle for longer than planned meaning that once pent up demand is met, sales may subsequently drop off.

“Demand over the course of the year will also likely be affected by consumers’ financial situations. Should unemployment rates continue to rise, new car sales could stall. However, with many consumers looking for a public transport alternative, demand for cheaper models could fuel the used car market.

“The auto industry typically works on a five to six month production planning cycle meaning that if September doesn’t herald an uptick in sales, more challenging decisions may need to be made for Spring 2021. Some manufacturers might predict sales returning to normal over the next six months, but the consensus view is likely to be less optimistic, potentially impacting planned production.

“Should factories continue to operate below capacity, the pandemic financial support from manufacturers that has been offered to dealerships to date will likely be reduced, or in some cases withdrawn. This could lead to further discounting to ensure new car stock is moved quickly from forecourt to consumer.”