Northridge Finance has announced a year of record growth reporting profit before taxation of £173 million, up from £151 million in 2017, for the twelve months ended 31 December 2018.

Northridge, which acquired Marshall Leasing in November 2017, has been able to fund a broader range of deals through new and long-term relationships, helping businesses and individuals to access finance, while strengthening its position as the consistent alternative to the market leaders in motor finance

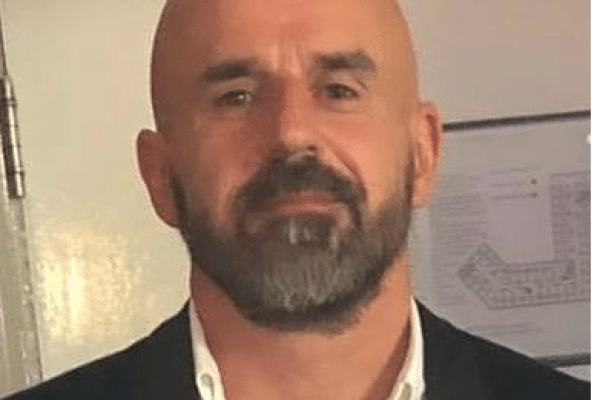

James McGee, Managing Director, Northridge Finance said, “We have seen superb growth in a challenging market environment and we are delighted to exceed £1 billion in lending and 8,000 vehicles in our funded fleet with Marshall Leasing. Both are firsts for our business.

“We are continuing to see strong used car values across the market and while there is a growing appetite for finance on electric cars, we have seen no significant downturn in the demand for used diesel vehicles.

“This is our first full financial year with Marshall Leasing. Both businesses are customer-centric, and the cultural fit has been one of the real strengths of the acquisition.

Appointed Representative Opportunities with Wessex Fleet

Have you thought about growing your broker business? Are you looking for opportunities for growth? Then why not consider joining Wessex Fleet as an Appointed Representative?

Keeping you on the move with leasing solutions tailored to your needs

Leasys is the proud Contract Hire partner of the Stellantis brands, offering mobility solutions from medium and long-term rentals to management systems for company fleets.We work with Brokers to support all their customers requirements.

Accelerate your business with QV Systems & Leaselink

Unlock unparalleled efficiency in vehicle procurement with QV Systems’ Accelerate, now seamlessly integrated with Ebbon Automotive’s Leaselink. Tailored for brokers and funders, this integration streamlines the entire process from quote to delivery, empowering you to effortlessly source and order vehicles for your clients.

“We are able to offer products through Northridge and Marshall Leasing channels, affinity schemes and via partnerships with intermediary networks. We have seen an increase in business of 31%, strengthened our long term relationships and have grown our network of retailers.

“In 2018, we have extended our platform eSign capability to various partner groups leading to enhanced digital pay-out flow, providing a faster and more convenient service for those partners and customers. In 2019, this rollout will continue and we will increase automation on our credit score system, building on the success of our Go365 app which helps motor dealers keep track of cases while on the forecourt.

“Our focus will be continuing to improve service and investing in new technology so we can serve our customers brilliantly.”

Peter Cakebread, Managing Director, Marshall Leasing said: “We have exceeded the 8,000 funded fleet vehicle milestone and our entry into the intermediary market is generating strong orders.

We have continued the rapid expansion of our Minibus offering, taking the fleet to 139 vehicles, an increase of 283%.

“Our shared outlook and goals are driving the businesses forward together and this is benefitting our customers through more products, better technology and a broader team of experienced professionals to deliver great service. We plan to go from strength to strength.”