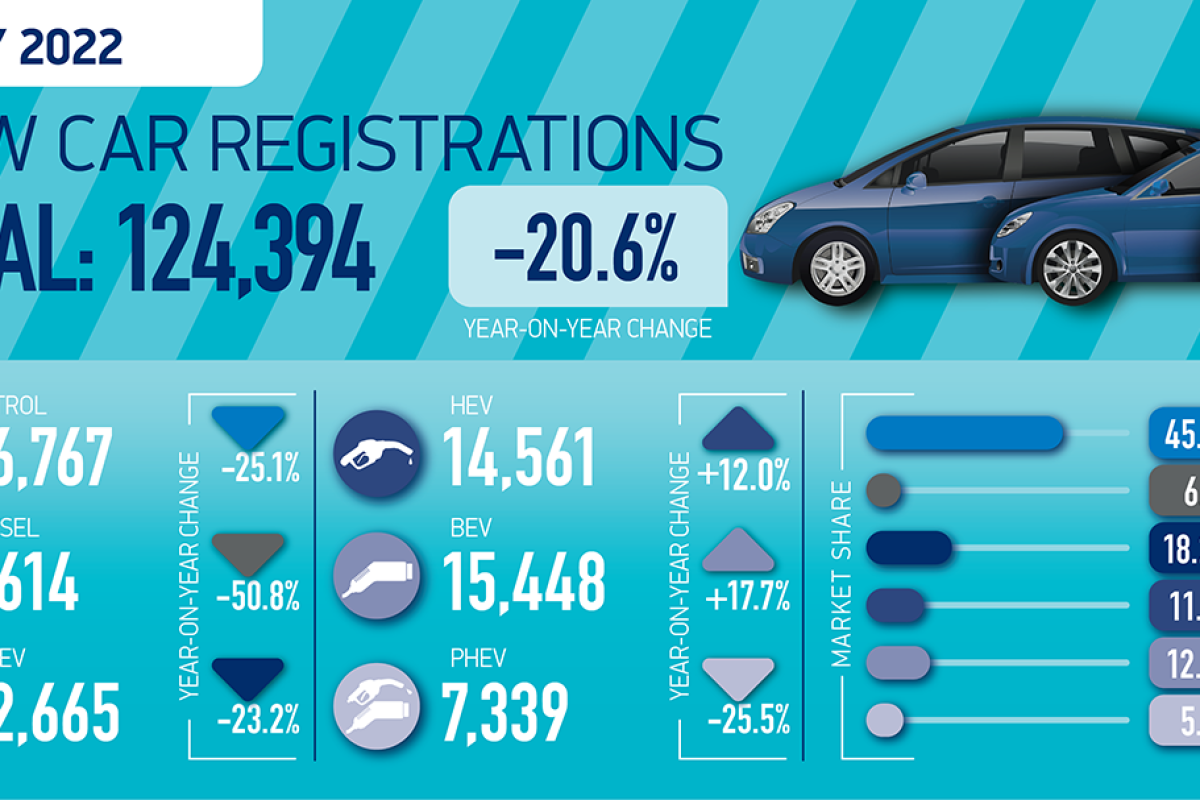

THE UK car industry continues to reel under the trilemma of supply chain pressures, geopolitical unrest and rising inflation. May was a similar story to the first four months of the year, as SMMT data showed that just over 124,000 cars were registered, a 20.6% decrease over 2021 when car showrooms were open for the first full month after lockdown, but almost a third lower than pre-pandemic 2019.

Manu Varghese, from EY’s UK NS Ireland Advanced Manufacturing and Mobility Team, said that although supply chain disruptions during the COVID-19 pandemic have been a causal factor for the challenges experienced today, recent geopolitical tensions in Europe have further aggravated this crisis.

He added: “Also, the rapid shift to electric vehicle (EV) production has created an emerging risk related to EV battery availability because of dependence on minerals mined in countries impacted by the geopolitical volatility. Automotive companies have, to a certain extent, managed to acclimatise to the supply chain challenges by reducing production with several OEMs embarking on supply chain transformation initiatives given its criticality and a recognition that the crisis could get worse before it recovers.

“Record levels of unfulfilled orders have also forced OEMs to optimise their product and production mix. Forward looking statements issued by automakers have indicated a shift to higher margin variants both in the UK, and globally. With production capacity being constrained by raw material shortages and availability of components, OEMs are closely reviewing their offerings, increasing pricing and also scaling back variable marketing expenditure. The sector also saw a marginal decrease in used car prices as the market slightly course corrected, following more than a year of sustained increase in prices.

New UK car registrations fell 20.6% to 124,394 units in the second weakest May since 1992, after the 2020 pandemic-hit market, as supply shortages continued to hamper new purchases and the fulfilment of existing orders.

Appointed Representative Opportunities with Wessex Fleet

Have you thought about growing your broker business? Are you looking for opportunities for growth? Then why not consider joining Wessex Fleet as an Appointed Representative?

Keeping you on the move with leasing solutions tailored to your needs

Leasys is the proud Contract Hire partner of the Stellantis brands, offering mobility solutions from medium and long-term rentals to management systems for company fleets.We work with Brokers to support all their customers requirements.

Accelerate your business with QV Systems & Leaselink

Unlock unparalleled efficiency in vehicle procurement with QV Systems’ Accelerate, now seamlessly integrated with Ebbon Automotive’s Leaselink. Tailored for brokers and funders, this integration streamlines the entire process from quote to delivery, empowering you to effortlessly source and order vehicles for your clients.

The SMMT said the decline, compared with the first full month of reopened showrooms in May last year, demonstrates the impact of continued global supply chain disruptions, with the market 32.3% below the 2019 pre-pandemic level despite strong order books.

While private consumer purchases fell 10.3%, their market share increased year-on-year by 6.1 percentage points to 53.2%, in part due to manufacturers striving to fulfil deliveries – particularly of electric vehicles – to private buyers, with the commensurate effect on the business and large fleet sectors, which now comprise 46.8% of the market.

Despite the myriad challenges affecting the industry and a high level of market distortion due to restricted supply of all vehicle types and technologies, manufacturers have worked hard to sustain progress towards the decarbonisation of road transport and the delivery of UK’s ambitious net zero targets.

Jamie Hamilton, Automotive Director and Head of Electric Vehicles at Deloitte, said: “Despite an overall decline in new car sales electric vehicles managed to achieve 18% growth in May and, as a result, almost one in eight new cars sold were fully electric. With fuel prices at the pump at record highs, many consumers are thinking more about the potential benefits of moving to electric; some for the first time. Were it not for continued supply constraints, the growth of EVs could have been even sharper this month.

“Fleets have an important role to play in speeding up the transition to electric. However, fleet managers need to be given more support in order to realise the benefits and opportunities associated with a holistic transition to electric, rather than just a standard ‘vehicle by vehicle’ replacement.”

May saw registrations of battery electric vehicles (BEVs) rise by 17.7%, representing one in eight new cars joining the road last month. Plug-in hybrids declined 25.5%, while hybrids were up 12.0%, meaning deliveries of electrified vehicles accounted for three in 10 new cars.

Superminis continued to be the most sought-after segment by British motorists, making up 32.7% of registrations in the month, despite their registrations falling 16.4% to 40,667 units, followed by dual purpose, which accounted for 28.9% of the market even after a 14.1% fall in volumes. The small volume luxury car segment was the only area of growth, up 16.8%, to 369 units.

The supply chain challenge has contributed to an overall market decline in the year to date of 8.7%, equivalent to 62,724 fewer units. This is 40.6% below the five-year average recorded from January to May, as the new car market continues to struggle to emerge from the impact of the pandemic.