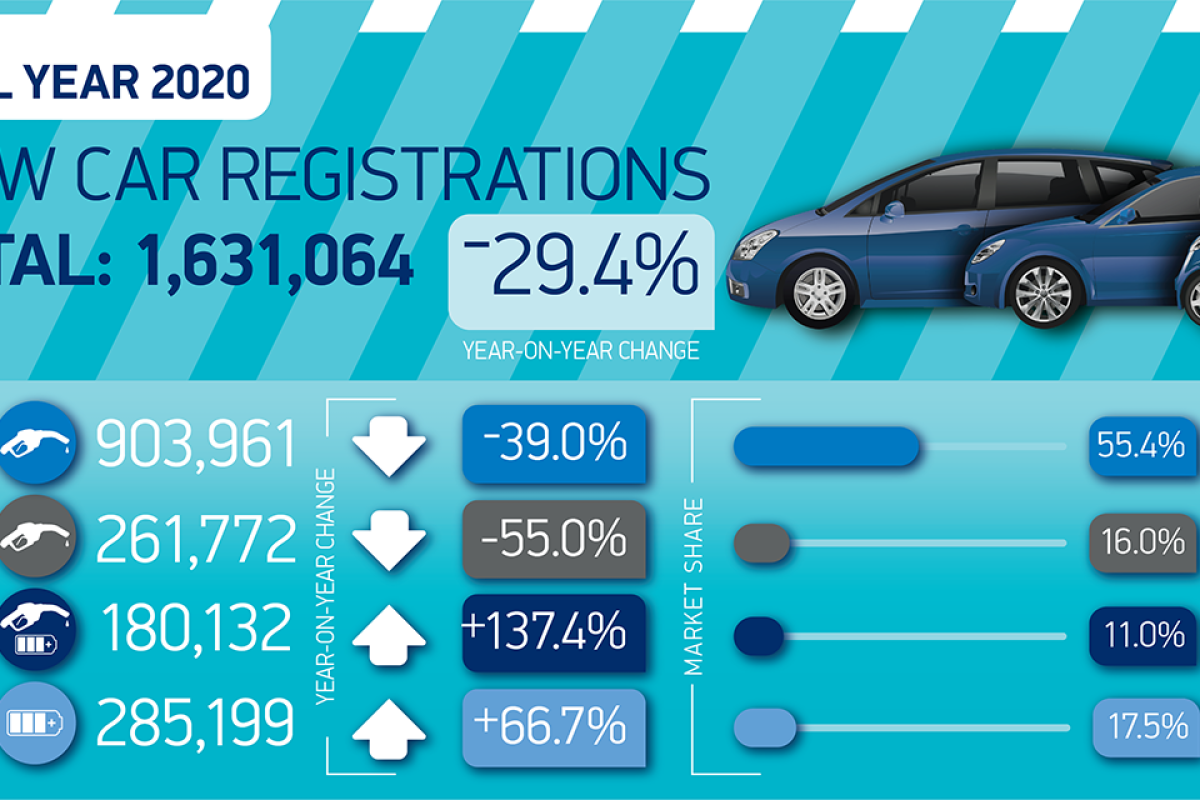

A 10.9% decline in December wrapped up a turbulent 2020, which saw demand for new cars fall by 680,076 units to the lowest level of registrations since 1992.

Against a backdrop of Covid restrictions, an acceleration of the end of sale date for petrol and diesel cars to 2030 and Brexit uncertainty, the industry suffered a total turnover loss of some £20.4 billion

Commenting on the latest SMMT Car Registration figures, Karen Johnson, Head of Retail and Wholesale at Barclays Corporate Banking, said that December’s vehicle registrations were reflective of what was a highly turbulent year, although the month showed signs of continued consumer interest in both used and electric vehicles.

She added: “A number of manufacturers were reported to have pushed forward the registration of cars in December in order to get ahead of the Brexit transition deadline, whilst some consumers may also have decided to make purchases before this key date in order to guarantee prices had there been a ‘no deal’. However, neither of these was enough to prevent a decline in new vehicle registrations versus the same month in 2019.

“Looking ahead, dealers will be relying on the improvements that they made to their e-commerce offerings during the first lockdown in order to cope with this latest set of restrictions. Although this won’t be the New Year start that many would have hoped for, the experience gained from previous lockdowns may provide at least a thin silver-lining to the clouds ahead.”

Appointed Representative Opportunities with Wessex Fleet

Have you thought about growing your broker business? Are you looking for opportunities for growth? Then why not consider joining Wessex Fleet as an Appointed Representative?

Keeping you on the move with leasing solutions tailored to your needs

Leasys is the proud Contract Hire partner of the Stellantis brands, offering mobility solutions from medium and long-term rentals to management systems for company fleets.We work with Brokers to support all their customers requirements.

Accelerate your business with QV Systems & Leaselink

Unlock unparalleled efficiency in vehicle procurement with QV Systems’ Accelerate, now seamlessly integrated with Ebbon Automotive’s Leaselink. Tailored for brokers and funders, this integration streamlines the entire process from quote to delivery, empowering you to effortlessly source and order vehicles for your clients.

Michael Woodward, UK automotive lead at Deloitte, said it was unsurprising to see year-on-year new car sales fall by 11% in a month that is nearly always quiet for dealers; reflected in both private (-14%), and fleet (-8%) sales.

“2020 saw 29% fewer new cars on the road than in 2019, marking a fourth consecutive year of declining sales and suggesting the fallout may be felt for some time still.

“However, many manufacturers and dealers remain optimistic for the year ahead, in spite of the latest UK lockdown measures. Whilst showrooms will be closed as in previous lockdowns, manufacturing facilities are expected to remain open this time. For dealers, click and collect, MOT and repair services also remain permitted offering a valuable, and profitable, lifeline.

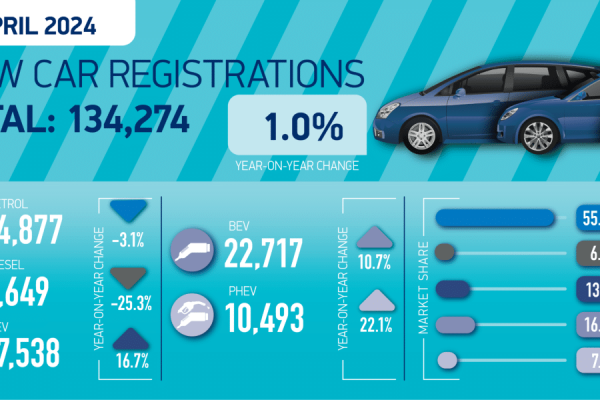

One in ten vehicles sold in the UK now electric

“Electric vehicles continued to outperform the market in December. Both battery electric (BEV) and plug in hybrid (PHEV) vehicles saw year-on-year growth this month, of 344% and 103% respectively. Combined, electric vehicles grew their market share to 23%, up from 6% this time last year. Overall, 2020 was a significant year for EVs with sales topping 175,000 and market share reaching 11%.

“The stage is set for further growth with the government and manufacturers showing significant commitment to EVs. For example, bringing forward the ban on new petrol and diesel sales to 2030 brings the UK in line with some European markets, such as Ireland and The Netherlands, and is more ambitious than many other major European markets; in some cases by a decade.

“This show of commitment, coupled with financial and tax incentives and a growing focus on the green agenda, will make EVs more desirable than ever in 2021 and the sector will have diesel’s 16% share of the market firmly within reach.

“Speed of growth over the next year will depend on consumer confidence in the UK’s’ charging infrastructure. However, we need only look at Norway, which recently reached a landmark EV market share of 54%, to see what is possible with all pieces of the jigsaw in place.”

Lucy Simpson, Head of EV Enablement at Centrica Business Solutions, said that despite the uncertainty caused by the pandemic, the 185% year on year increase in the number of EVs on the UK’s roads was encouraging.

“Barriers to adoption like vehicle choice and range anxiety seem to be disappearing as fleet-operators become more convinced of the benefits of making the switch. A more proactive approach towards sustainability from business is a major reason for this increased appetite for zero emission vehicles.

“Government support for charging infrastructure is also playing a key role and we support a Zero Emission Mandate for car manufacturers to ensure the UK transitions to electric by 2030, but in the interim EV purchase grants should continue.

“Switching to EV also creates an opportunity for firms to shift how they think about energy and become generators, rather than just consumers of energy. For example, using distributed energy technologies like on-site solar generation and battery storage will allow EV operators to generate, store and deploy electricity to EVs directly and sell any surplus energy generated back to the grid. This can unlock new revenue streams and turn energy from a cost into a commodity.”